$120m in JobKeeper clawed back by ATO, new compliance areas highlighted

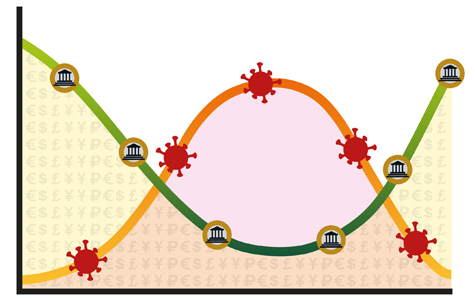

About $120 million in JobKeeper payments have been recovered by the ATO due to businesses making deliberate or reckless mistakes, as fresh guidance on its JobKeeper extension compliance focus lands.

‘Follow the spirt of the law’, warns ATO

The Australia Taxation Office has cautioned businesses against taking advantage of the government’s most recent expanded asset write-off scheme and the new loss carry-back provision.

Employers cautioned over ‘hard and fast’ decline in turnover eligibility

Accountants assisting clients with the JobKeeper extension have been urged to pay close attention to the actual decline in turnover test, with the ATO unable to offer leeway for those who come just shy of the requirements.

Businesses not meeting obligations warned as ATO restarts compliance programs

The ATO has warned businesses not staying up to date with their obligations that it may impact their eligibility for future stimulus measures, as the Tax Office readies to recommence its work to address key risks to the tax and super system.

Comprehensive list of COVID-19 initiatives and packages.

The response by our Governments to the COVID-19 crisis has been a very good one. Following is a comprehensive listing of links to important Federal and State initiatives and programs since the pandemic began.

Part 3 – Budget reminders. Under the Hood.

The 2020 Federal Budget was one of the most far reaching and complex ever brought in. This is the first of three articles to remind us of important topics the budget addressed.

Part 2 – Budget reminders. Under the Hood.

The 2020 Federal Budget was one of the most far reaching and complex ever brought in. This is the second of three articles to remind us of important topics the budget addressed.

Part 1 – Budget reminders. Under the Hood.

The 2020 Federal Budget was one of the most far reaching and complex ever brought in. This is the first of three articles to remind us of important topics the budget addressed.