Working from home during a COVID-19 lockdown: Can you claim a tax deduction for rent?

The ATO has long held firm on the principle that rent payments (being a form of occupancy costs) are generally outgoings “of a private or domestic nature” and therefore not deductible, even where part of the rented home is used as a home office. However, it has been accepted that in some circumstances, a rent deduction may be claimed if a part of the home is used exclusively for income-producing activities and there is no alternative place of business provided by the taxpayer’s employer.

Recontributions of COVID-19 early released super

Under the COVID-19 early release measures, individuals could apply to have up to $10,000 of their super released during the 2019–2020 financial year and another $10,000 released between 1 July and 31 December 2020.

ATO announces STP Phase 2 blanket deferral

Australian employers will now have two more months to transition to the second phase of Single Touch Payroll as the ATO announces a blanket deferral in light of the current business environment.

Reminder: super changes for the 2021 financial year

The government’s long-slated “flexibility in superannuation” legislation is finally law.

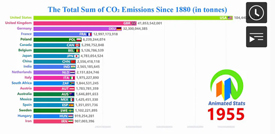

Greenhouse gas emission by country since 1880

The total sum of CO2 emissions since 1880 (in tons). Food for thought, that's for sure

Treasury consults on increase to charities financial reporting threshold

The revenue thresholds defining small, medium and large charities are set to be raised, saving over 5,000 charities the need to produce reviewed or audited financial statements.

ATO extends COVID-19 relief for SMSFs

The ATO has made an extension to several COVID-19 compliance relief for SMSFs to cover the 2021-22 financial year.