The Most Held Currencies in the World | 1850-2024

Check out the most powerful Currencies in the World | 1850-2024

Vacant Residential Land Tax

Commencing 1 January 2025, vacant residential land tax (VRLT) applies to all Victorian homes unoccupied for more than 6 months in a calendar year, unless an exemption applies

All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

Building Australia’s future and Budget Priorities

Building Australia's future and Budget Priorities

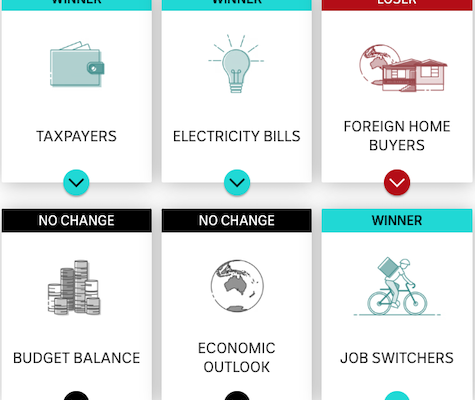

Winners and Losers – Federal Budget 2025-26

Treasurer Jim Chalmers has handed down his fourth federal budget, laying the groundwork for a federal election campaign that could be called within days.

What does the proposed changes to HELP loans mean?

If you are one of the millions of Australians with Higher Education Loan Program (HELP) debt, the proposed changes may offer some benefit.

Tax planning tips for 2024-2025

Plan for End-of-Financial-Year (EOFY) early

Tax Office puts contractors on notice over misreporting of income

The ATO's data matching programs have identified contractors that are incorrectly reporting or omitting contractor income.

ASIC pledges to continue online scam blitz

The corporate regulator has revealed online scammers will remain “squarely in the crosshairs”, with 130 investment scams shut down weekly.

ATO to push non-compliant businesses to monthly GST reporting

Small businesses with a history of not complying with their obligations may be moved to monthly GST reporting from the start of April, the ATO has warned.

ATO outlines focus areas for SMSF auditor compliance in 2025

The ATO has issued guidance on what it will focus on regarding auditor compliance for 2025.