State and Federal Covid support — Aug 2022

The following links are to the latest state and federal government plans, schemes, programs, and initiatives to help businesses and individuals manage continued national hardships.

ATO adds indebted sole traders to credit referrals

The step should help promote transparency and fairness, says IPA. The ATO has begun disclosing tax debts of sole traders to credit reporting bureaus (CRBs) if they meet its criteria for referral.

A trio of trip-wires businesses should avoid, says ATO

Wayward habits accentuated by the pandemic will be a compliance focus.

Documentation key in preventing ‘disappearing crypto’, SMSFs told

Thorough documentation can help mitigate the risk of crypto assets going missing in situations like divorce, says a specialist lawyer.

Tax Office homing in property deductions, SMSFs warned

With property deductions a big focus for the ATO this tax time, SMSFs have been warned on some of the pitfalls in this area that can land them in trouble.

Sub-trusts ‘redundant’ under final Div 7A ruling

With interest-only loans no longer an option the commercial incentive for sub-trusts ends, says the Tax Institute.

Tax time guide offers path through 100A

ATO update on trust distributions outlines key features of low and high-risk arrangements.

Write a business plan

A written business plan is essential to help you start and grow your business

Be wary of trust disclaimers, ATO warns

Beneficiaries are urged to understand the tax effect of entitlements in the wake of a recent High Court decision.

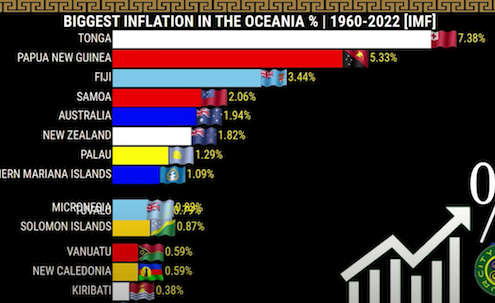

Largest inflation rates by country in Oceania

See how the inflation rates changed from 1960-2022

Single Touch Payroll: Phase 2 deferral reminder

First update was in January 2022, now phase 2.

Census 2021 Data

Search through the data collected by the Australian Bureau of Statistics, and find interesting facts about how the country is changing.