Building Australia’s future and Budget Priorities

Building Australia's future and Budget Priorities

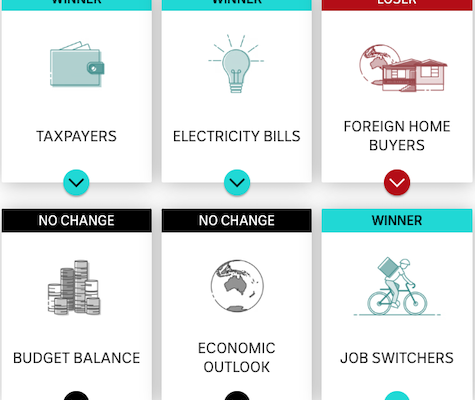

Winners and Losers – Federal Budget 2025-26

Treasurer Jim Chalmers has handed down his fourth federal budget, laying the groundwork for a federal election campaign that could be called within days.

What does the proposed changes to HELP loans mean?

If you are one of the millions of Australians with Higher Education Loan Program (HELP) debt, the proposed changes may offer some benefit.

Tax planning tips for 2024-2025

Plan for End-of-Financial-Year (EOFY) early

Tax Office puts contractors on notice over misreporting of income

The ATO's data matching programs have identified contractors that are incorrectly reporting or omitting contractor income.

ASIC pledges to continue online scam blitz

The corporate regulator has revealed online scammers will remain “squarely in the crosshairs”, with 130 investment scams shut down weekly.

ATO to push non-compliant businesses to monthly GST reporting

Small businesses with a history of not complying with their obligations may be moved to monthly GST reporting from the start of April, the ATO has warned.

ATO outlines focus areas for SMSF auditor compliance in 2025

The ATO has issued guidance on what it will focus on regarding auditor compliance for 2025.

Best Selling BOOKS of all Time

Check out the Best Selling BOOKS of all Time

Have you considered spouse contribution splitting?

Your individual total super balance as of 30 June each year impacts your ability to implement various super strategies in the following financial year.

Exploring compassionate early release of super

Even though superannuation is designed for retirement, there are limited circumstance where you can access super early on compassionate grounds.

Government to push ahead with GIC deduction changes

A proposed measure to deny deductions for the general interest charge has received the green light from a Senate Committee.