What business needs to know about the skills and technology boosts

Proposed measures for a bonus 20 per cent tax deduction to incentivise spending on training and digital uptake are back on track.

Declare cash sales or run the risk, business told

Off-the-books transactions and side hustles have a habit of showing up the ATO’s tracing technology, says Assistant Commissioner.

Australian Taxation Office (ATO) reminder to small businesses this tax time

Small businesses are again in the ATO’s sights this tax time, with a focus on stamping out deductions not related to business income, overclaiming of expenses, omission of business income and insufficient records to substantiate claims.

What is Single Touch Payroll Phase 2?

In the 2019–20 Budget, the government announced that Single Touch Payroll (STP) would be expanded to include additional information.

Bear Markets and What Investors Can Do Now

Six biggest bull markets in US stocks/shares since 1962 and their subsequent bear markets.

Claiming a tax deduction for expenses for a home-based business

If you operate some or all of your business from your home, you may be able to claim tax deductions.

Super changes apply, don’t get caught short

To avoid additional costs (including the superannuation guarantee charge (SGC)), you must pay the right amount of super for all your eligible employees by the quarterly due date.

Chalmers revives 120% deductions for spending on skills, digital

The government has revived two initiatives that give small businesses 120 per cent tax deductions for spending on training and digital uptake which were first announced in the March budget.

Cyber Security – Optus data breach

In light of the recent Optus data breach, we thought it timely to provide a list of things you should consider to help protect your identity

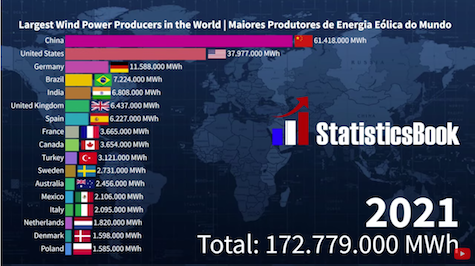

LARGEST WIND POWER PRODUCERS IN THE WORLD

Check out the worlds largest wind power producers from 1990 to 2021

Cyber security and work-from-home become key executive concerns

Cyber crime and data breaches are rated higher as threats by executives in the Asia Pacific than by their global counterparts, with more than half saying security risks had risen over the past 12 months.

Tax benefits for unused “carry forward” concessional superannuation contributions

A reminder regarding rules for allowing eligible people to claim tax deductions for the unused portion of their super concessional contributions caps from prior years.