Post Federal budget reflections

The federal budget 2021–22 was handed down by the Treasurer, the Hon Josh Frydenberg MP, on 11 May 2021. This article considers the key issues as we wait for the legislative amendments to give effect to the budget measures.

ATO sheds light on crypto compliance focus

The Tax Office has urged advisers and taxpayers alike to heed its guidance on accounting for cryptocurrency come tax time, when it will be looking to ensure that all capital gains events are accurately reported — not just gains.

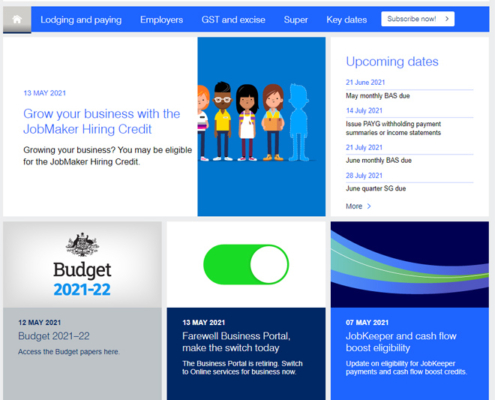

ATO Small Business Newsroom – May / June

The ATO provides information on a large number of business related topics, issues, rules and regulations. We hope this article will help quickly you keep up to date.

Videos to help understand accounting topics.

Often watching a short video is a quicker way to understand what can otherwise be quite confusing. The following titles have just been added to our website and can be accessed at any time and by anyone.

Closely held payees: STP options for small employers

Small employers with closely held payees have been exempt from reporting through single touch payroll (STP).

End of year financial strategies

With the end of the financial year approaching there may be some valuable opportunities worth discussing for you or your family, depending on your personal circumstances.

10% Super Guarantee from 1st July 2021

Business leaders should turn their attention to how they plan on managing the government’s increase to the superannuation guarantee, set to come into effect from 1 July, to avoid penalties, says one tax expert.