Main residence exemption myths and misconceptions

The surge in the residential property market continues to attract buyers and sellers, many involving the family home. This article considers the common myths and misconceptions when it comes to being eligible for the main residence exemption.

Unused Super Contributions

The carry-forward rules are often overlooked by eligible individuals who do not use the full amount of their concessional contributions (CCs) cap in a particular financial year.

Superannuation changes – Superannuation guarantee (SG)

One changes in this area.

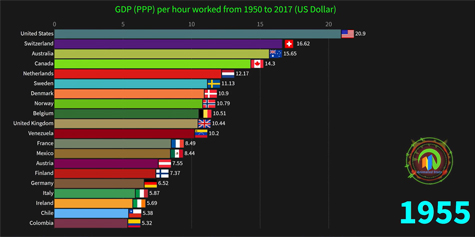

World’s most productive countries

The following animated chart covers the period from 1950 to 2017. It is fascinating to see how the world changes over time.

Government moves to scrap SG $450 threshold

The government is finally delivering on its budget promise to remove the $450 per month superannuation guarantee threshold.

Business valuations: Tips, tricks and traps

Business valuation is often described as a dark art. Indeed, get three different valuers to value the same asset and you will likely end up with three very different results. But this doesn’t need to be the case.

Company directors must register – all you need to know

A director identification number (director ID) is a unique identifier you will keep forever. It will help to prevent the use of false or fraudulent director identities.

Hardship priority processing of tax refunds

If your business is experiencing financial difficulties from the many lockdowns, the Australian Taxation Office (ATO) may be able to help by processing the tax return faster, if you are due a refund.