100A ruling ‘turns tax avoidance logic on its head’

The ATO’s 100A draft ruling on trusts has turned the logic of “tax avoidance” on its head and may be fundamentally flawed, according to tax law specialist Ron Jorgensen.

Tax Time Checklists – 2022 Individuals; Company; Trust; Partnership; and Super Funds

100A ruling turns tax avoidance logic on its head

The ATO’s 100A draft ruling on trusts has turned the logic of “tax avoidance” on its head and may be fundamentally flawed, according to tax law specialist Ron Jorgensen.

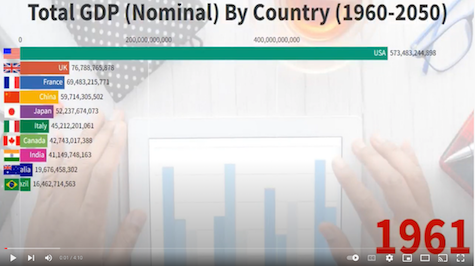

World GDP Ranking (1960~2025)

The following animated chart covers the period from 1960 to 2025. It is fascinating to see how the world changes over time.

Inflation will force a third of businesses to raise prices

More than a third of businesses expect to impose larger-than-usual price rises in the next three months, the latest Australian Bureau of Statistics data found.

Forget the Tim Tams in your WFH claim, say ‘fun police’

Humour has become the weapon of choice for CPA Australia when it comes to raising awareness of accountants at tax time.

Forget the Tim Tams in your WFH claim, say fun police

Humour has become the weapon of choice for CPA Australia when it comes to raising awareness of accountants at tax time.

ATO zeroes in on work expenses, crypto investments

The Tax Office has revealed its priority areas for this year’s returns.

ATO and non-commercial loses

The ATO understands the past few years have been difficult, with floods, bushfires, and COVID-19 affecting many businesses. The ATO wants to help make it easier for businesses impacted by these events, and so have developed a practical compliance guideline (PCG) that may assist. The ATO develops PCGs to address the practical implications of tax laws and outline our administrative approach.