Christmas ‘crunch time for economy, inflation outlook’

Christmas will be crunch time for the economy because an end-of-year bonanza would add fuel to the inflation fire, says HLB Mann Judd.

Small business debt and tax gap at top of ATO hit list

Small business has shot to the top of the ATO’s hit list because it emerged from COVID-19 responsible for the biggest tax gap and almost two-thirds of the $37 billion tax debt, a commissioner says.

Sole traders cut back super, work longer hours

Rising costs and extra paperwork has hit work-life balance for independent earners, specialist accountancy says.

Budget: all the key points you need to know

A rundown of the main measures that will impact accountants and small business.

Federal Budget 2022/23 – Documents and Facts Sheets

All the detail for those who like to better understand the fine print.

Federal budget 2022 — Winners and Loser

After 10 years out of government, Treasurer Jim Chalmers has delivered Labor's first budget since its election victory in May.

Budget October 2022-23-Comprehensive summary

The Federal Government is to continue spending more than it earns for at least the next two years at least.

Australian Taxation Office-(ATO) reminder to small businesses this tax time

Small businesses are again in the ATO’s sights this tax time.

Take action on valuations now to avoid delays, says ATO

The ATO is urging SMSFs to get their asset valuations done before their annual audit to help avoid delays and late lodgements.

Australian Taxation Office warns against asset wash sales

With COVID-19 lockdowns and restrictions in the rear-view mirrors of most of the country, the ATO is also beginning to resume ordinary compliance activity levels.

ATO’s interest charges hit highest level in seven years

The ATO has raised both its general interest charge (GIC) rate and shortfall interest charge (SIC) rate for the next quarter, increasing both by more than 1 per cent.

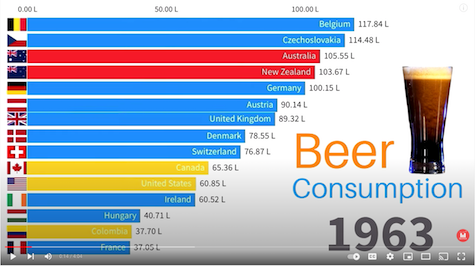

The Countries that Consume the Most Beer in the World

Check out the countries that consume the most beer from 1963-2021