Federal Budget 2022 and YOU – Part 2

Part 2: The second half of a detailed breakdown of last night’s Federal Budget. Also included are the budget documents themselves for those who like their information to be as granular as possible. Part 2 is set out in this way to help quickly find information that affects you, your family, and your region.

State and Federal Disaster support — March 2022

The following links are to the latest state and federal government plans, schemes, programs, and initiatives to help businesses and individuals manage the impact of yet further national hardships.

Federal Budget 2022 and YOU – Part 1

Part 1: Any government Budget consists of information about all areas the respective government manages for the tax payer. The Federal Budget is no exception and set out below are half of the areas this year's Budget covered. It is set out in this way to help quickly find information that effects you, your family and your region.

Federal Budget 2022 – Overview

The following is a breakdown of the major parts of the Federal Budget delivered last night by the Treasurer, Josh Frydenberg.

Superannuation Guarantee (SG) increases

Between the 1st of July 2022 to the 1st of July 2026 there will be five SG increases.

Undisclosed income risks hefty asset betterment assessments

The Federal Court are satisfied with asset betterment principles – a controversial approach the Australian Taxation Office (ATO) takes to determine undisclosed income.

How stress and burnout are different, and why the difference is important

It’s helpful to keep the distinction between burnout and stress clear so as not to burden individuals with responsibility for fixing workplace issues that require management attention, writes Dr Karen Morley.

Accountants ‘have important role to play’ in digital transformation

The accounting profession is being encouraged to aid small businesses through their digital transformation journey, with the Morrison government making a $2.8 million commitment to streamline electronic transactions.

ATO launches campaign to target tax withholding on overseas royalties

ATO has embarked on a new campaign to target private wealth groups withholding tax on overseas royalties.

ATO releases new draft guidance products impacting private trusts

The ATO has released a suite of new guidance products that is set to have a major change on family trust distributions and tax arrangements.

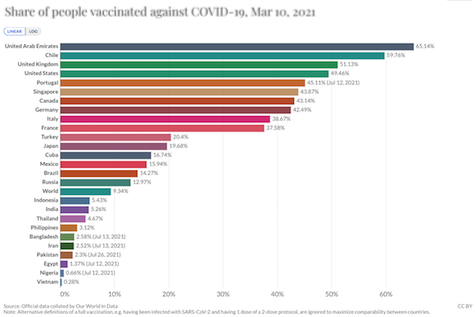

Vaccination rates (Dose)

61.4% of the world population has received at least one dose of a COVID-19 vaccine. 10.2 billion doses have been administered globally, and 18.22 million are now administered each day. Only 10% of people in low-income countries have received at least one dose.

Russia/Ukraine: Rising geopolitical risks and portfolio implications

Given the enormity of Russia's decision to invade Ukraine, this note provides a short update on the potential market implications.