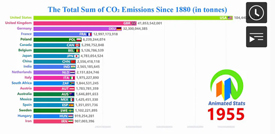

Greenhouse gas emission by country since 1880

The total sum of CO2 emissions since 1880 (in tons). Food for thought, that's for sure

Treasury consults on increase to charities financial reporting threshold

The revenue thresholds defining small, medium and large charities are set to be raised, saving over 5,000 charities the need to produce reviewed or audited financial statements.

ATO extends COVID-19 relief for SMSFs

The ATO has made an extension to several COVID-19 compliance relief for SMSFs to cover the 2021-22 financial year.

Government expands SME loan scheme eligibility

Businesses that didn’t previously receive JobKeeper will now be eligible for loans of up to $5 million under the scheme, which will be made available through select lenders until 31 December.

Pitfalls and proposed changes in the use of R&D tax incentives

Since its introduction, a number of taxpayers have fallen foul of the ATO in its administration of the research and development (R&D) tax incentive scheme under the Income Tax Assessment Act 1997 (Cth) (ITAA) for failing to have claimed an offset for an activity that strictly complies with the relevant tests.

Extra ‘super’ step when hiring new employees

Most new employees are eligible to choose the super fund you pay their super guarantee contributions to.

World’s largest armies 1816 – 2020

ATO issues warning to first-time investors

A surge in first-time investors trading shares and exchange-traded funds (ETF) has prompted the ATO to issue a warning on share tax treatment and the behaviour that raises red flags.

Unemployment rate falls to 12-year low

The latest round of employment data shows the unemployment rate fell by 0.3 of a percentage point to 4.6 per cent through July. But the 12-year low might not signify labour market strength, experts say.

Lockdowns and mental health

Victoria endures its sixth lockdown as the state's cases grow; NSW records 1,281 new local COVID-19 cases and three deaths. Lockdowns to be eased once 70% of the population is double vaccinated against COVID-19 yet today some 60% of Australians are in lockdown.

State and Federal COVID-19 support

The following links are to the latest state and federal government plans, schemes, programs, and initiatives to help businesses and individuals manage the impact of yet more COVID-19 restrictions.

NSW support measures, plus update for payroll tax.

A combination of information from the 13-7-21 and the 26-7-21.