ATO cracking down on tax dodgers trying to leave the country

The Tax Office is issuing departure prohibition orders as it moves to bolster payment performance and debt collection.

8 tips to improve your online sales

Online shopping sale days have become more common with a number of major events throughout the year.

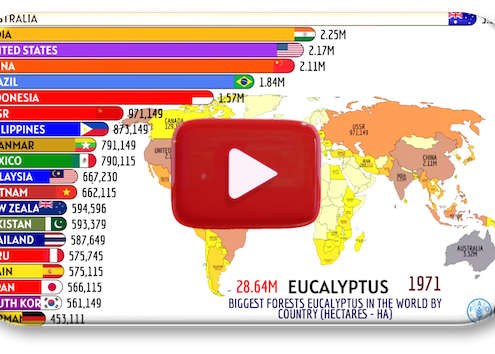

Countries with the largest collection or eucalyptus trees

Check out the countries that have started to grow their eucalyptus tree stocks

Super gender gap slowly narrows

The latest Financy Women’s Index (FWX) for the September quarter has shown the superannuation gender gap is closing, with true parity between men and women now predicted to be achieved in a more rapid timeframe.

Protecting yourself from misinformation

The Australian Taxation Office (ATO) has observed websites attempting to harvest personal information such as Tax File Numbers, identity details and myGov login credentials under the guise of providing “super advice”.

A refresher on Medicare levy and Medicare levy surcharge.

The Medicare levy’s a compulsory charge of 2% on taxable income, which helps fund Australia’s public healthcare system.

Payday Super part 1: understanding the new law

Passage of the Payday Super reforms by parliament this week has cleared the way for employee superannuation to be paid by employers more frequently. In the first of a two-part series, this article explains the myriad elements of the new law.

ATO’s holiday home owner tax changes spur taxpayers to be ‘wary and proactive’

Following on from the Tax Office’s move to refresh its approach to rental property tax deductions, tax advisers are warning holiday home owners to be wary of the coming changes.

Choose the right business structure step-by-step guide

Take out the guesswork out of choosing the right structure for your business

Restructuring Family Businesses: From Partnership to Limited Company

Family businesses form the backbone of the Australian economy, with many starting as simple partnerships before evolving into more complex structures

Net cash flow tax: What is it and what will it mean for SMEs?

As differing opinions circulate at the top end of town about the potential impacts of a net cash flow tax, its effect on SMEs could add to their daily struggle in the current regulatory environment.

How Many Countries Divided From The Largest Empire throughout history

Check out the countries that have been born from some of the largest empires in history.