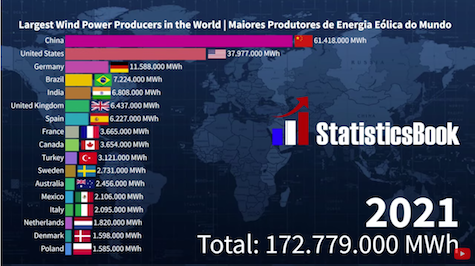

LARGEST WIND POWER PRODUCERS IN THE WORLD

Check out the worlds largest wind power producers from 1990 to 2021

Cyber security and work-from-home become key executive concerns

Cyber crime and data breaches are rated higher as threats by executives in the Asia Pacific than by their global counterparts, with more than half saying security risks had risen over the past 12 months.

Tax benefits for unused “carry forward” concessional superannuation contributions

A reminder regarding rules for allowing eligible people to claim tax deductions for the unused portion of their super concessional contributions caps from prior years.

Why you need a contract of employment

Many small businesses employ workers on a verbal agreement. But what happens if a dispute arises over the terms and conditions of someone’s employment – and there is nothing in writing?

NALI ‘a special problem for SMSFs’

Tax benefits attract miscreants, but non-arm’s length rules should allow minor transgressions to be fixed, says CA ANZ.

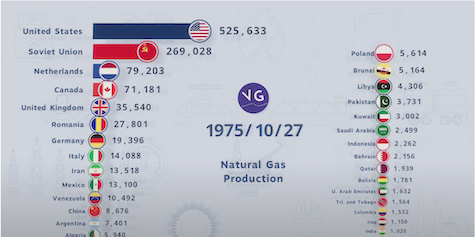

Largest natural gas produces by country from 1970-2021

See which country lead the worlds natural gas production at certain times in the last 50 years.

Proof of ownership flagged as ‘biggest’ crypto issue for SMSFs

SMSFs have been warned on some of the challenges in proving ownership of crypto assets, with only certain exchanges allowing SMSF accounts to be registered.

ATO casts net wide when it comes to taxable business income

Commissions, investment earnings, gratuities and more must be included to be assessed, the office warns.

State and Federal Covid support — Aug 2022

The following links are to the latest state and federal government plans, schemes, programs, and initiatives to help businesses and individuals manage continued national hardships.

ATO adds indebted sole traders to credit referrals

The step should help promote transparency and fairness, says IPA. The ATO has begun disclosing tax debts of sole traders to credit reporting bureaus (CRBs) if they meet its criteria for referral.

A trio of trip-wires businesses should avoid, says ATO

Wayward habits accentuated by the pandemic will be a compliance focus.

Documentation key in preventing ‘disappearing crypto’, SMSFs told

Thorough documentation can help mitigate the risk of crypto assets going missing in situations like divorce, says a specialist lawyer.