Last chance to claim the loss carry-back

Businesses that need a little more financial help will have one last opportunity to claim the

loss carry-back in their 2021–2022 income tax returns.

Largest cities in the world 1500 to 2100

The information in this chart is fascinating from both an historical perspective as well as what it predicts. It also guarantees you'll be the breakfast table expert every time.

State and Federal Disaster support — May 2022

The following links are to the latest state and federal government plans, schemes, programs, and initiatives to help businesses and individuals manage the impact of yet further national hardships.

E-invoicing will reduce emissions, says PwC

Digitising billing systems would save almost $130 million annually in carbon emissions

Be alert for phoenix activity, businesses told

The ATO says the best protection is “knowledge defence”.

Small businesses show sign of omicron rebound

Increased sales take Xero index into positive territory.

Data matching program: government payments

A data matching program designed to identify and address non-compliance with tax and super obligations is under way in relation to government payments for the 2018–2019 to 2022–2023 income years. It covers most services that the Commonwealth Government pays third-party program providers to deliver.

ATO puts 50,000 directors on notice.

The ATO is sending its strongest message on debt enforcement since the pandemic, says Grant Thornton.

State and Federal Disaster support — April 2022

The following links are to the latest state and federal government plans, schemes, programs, and initiatives to help businesses and individuals manage the impact of yet further national hardships.

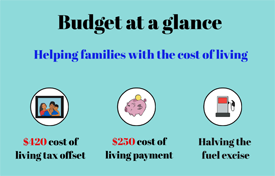

Federal budget 2022: Winners and Losers

With a federal election only a couple of months away, find out who's getting a cash boost — and who's not — in Treasurer Josh Frydenberg's latest budget.

FBT Reminder – Odometer Reading

Anybody who has a Fringe Benefits Tax obligation should take an odometer reading of motor vehicles

Budget at a Glance – Video

There are hundreds of pages and summaries you can read about this year's Federal Budget but this video is the only comprehensive option you can watch.