ATO’s good-faith approach to crypto won’t last much longer

The ATO has maintained its good-faith approach to the accounting of cryptocurrencies, though it isn’t expected to last much longer, says a national tax and accounting network.

ATO Small Business Newsroom

Help to keep up with the ATO.

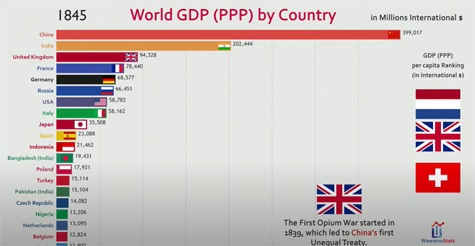

Country GDP 1800 to 2040

The information in this chart is fascinating from both an historical perspective as well as what it predicts. It also guarantees you'll be the BBQ expert every time.

Small businesses urged to register assets before insolvency explosion.

The Australian Small Business and Family Enterprise Ombudsman (ASBFEO) Kate Carnell says it is essential for small business owners to secure their assets and business loans, with economists predicting a steep rise in insolvencies this year.

ASIC sounds warning around high-yield bond scams

The corporate regulator has warned of a rise in scammers targeting Australian investors by pretending to be associated with well-known domestic and international financial service firms.

JobMaker Resources – ATO

All our key resources for the JobMaker Hiring Credit scheme. Included are a User Guide, four Factsheets, Information, a Payment Estimator, and a video.

Government mulls HECS-style business loans

A HECS-style loan scheme for businesses, currently being considered by the Treasury, would provide a lifeline for many industries recovering from the economic shock of COVID-19, says the small business ombudsman.

Industry pressure forces ATO’s hand on STP deadline

The Tax Office has agreed to push back the start date for the second phase of Single Touch Payroll after intense pressure from all corners of the profession.

$36bn withdrawn from super during COVID-19

The latest report from the Australian Prudential Regulation Authority (APRA) has revealed that workers withdrew more than $36 billion from retirement funds through the early release of super.

ATO opens claims for first JobMaker quarter

The first claim period for the JobMaker Hiring Credit scheme is now underway, with the ATO reminding employers that they could receive up to $10,400 for each eligible employee hired.

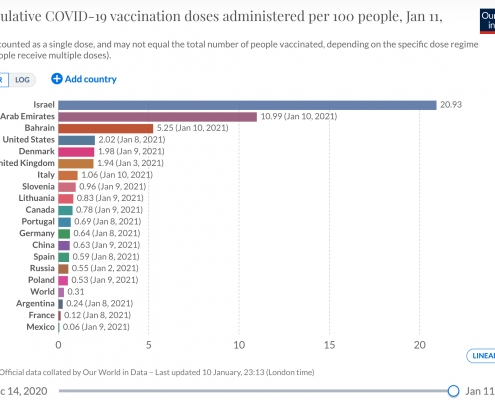

Vaccination rates as they happen around the world

A new resource is now available that shows the rates per country of COVID-19 vaccinations. We all suffered in many ways as COVID number increased, now, as expected, let's watch them start to drop.

80¢ per hour work-from-home deduction method extended

Taxpayers continuing to work from home in the new year will be allowed to continue using the simplified working-from-home deduction method following a third extension by the ATO.